Saudi Arabia

Find support in this market.

Ease of trading across borders

Importing a standard container of goods into Saudi Arabia requires:

Introduction

Saudi Arabia, which spans a geographical area roughly the same size as Western Europe, is strategically located in the heart of the Middle East. With a GDP of $750bn and a population of 30 million, it is the largest economy in the region. Following the recent launch of Vision 2030 and the National Transformation Programme, there is renewed momentum for business and trade between the UK and Saudi Arabia as the country builds new knowledge driven industries.

Economic snapshot (% annual growth rate)

| 2014 | 2015 | 2016-19 | |

|---|---|---|---|

| GDP | 3.6 | 3.5 | 2.0 |

| Export of goods and services | -1.8 | -0.3 | 5.6 |

| Import of goods and services | 6.6 | -2.8 | 3.7 |

| Inflation | 2.7 | 2.2 | 3.5 |

| Exchange rate (per $) | 3.75 | 3.75 | 3.75 |

| Population | 2.3 | 2.2 | 1.7 |

| Source: Oxford Economics |

Economic outlook

Saudi Arabia is the largest and most stable economy in the Gulf. The Saudi economy weathered the recent economic and financial crisis far better than other economies in the area, thanks largely to its prudent economic and financial policies. After a rise of 6.8% in 2012, GDP growth is expected to slow to 4.3% this year, close to the new IMF forecast of 4.4%. The main reason for the slowdown will be a 3.5% decline in oil output. In 2014, GDP growth is forecast to pick up a little to 4.6% as oil production rises. The non-oil private sector will benefit from a stronger global economy.

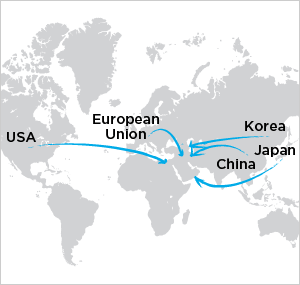

Trade outlook

Saudi exports are geared very much to the major oil consumers. China is expected to overtake Japan as the largest exporter in the next 10 years, with India becoming the second largest market followed by the US and Korea. China and India both demanding more oil inflows to continue to fuel their expected rapid growth rates will mean Saudi exports to the Asian region will grow particularly strongly. Exports to Latin America will also accelerate as energy demand in the region picks up in line with economic development. India and Turkey will be the two fastest-growing sources of imports.

Cultural tips

- Face-to-face business is essential. Be prepared to visit frequently.

- Saudi society is influenced heavily by the tenets of Islam.

- There are severe limitations on public interaction between men and women

Essential Customs tips

- De minimis: Dhahran values up to $200. Riyadh values up to $500.

- Both prescription and non-prescription drugs require approval from the Ministry of Health. This must be obtained in advance by the receiver, who is required to present a copy of the invoice to the Ministry of Health. Colognes and perfumes also require Ministry of Health approval.

- Alcoholic drinks are prohibited unless the receiver has an import permit.

SWOT analysis

| Strengths 50% of the population are under the age of 24 This large young population is tech savvy & interconnected Close historical relations with the UK and plenty of scope for expertise transfer |

Weaknesses Strongly dependent on the hydrocarbon sector Education system Unstable geo-political environment |

| Opportunities Construction Pharmaceutical Economic cities (see overleaf for further details) |

Threats Political risk The real estate market has not been immune to the regional property market woes |

Saudi Arabia's trade with the UK

Sector segmentation growth

Sectors to watch:

- Man-made fibres

- Coke & refined petroleum products

- Basic chemicals & fertilisers

Manufacturing

- Motors, except vehicles

- Chemicals

Fastest-growing exporters into Saudi Arabia

| Rank | 2012 |

|---|---|

| 1 | India |

| 2 | Turkey |

| 3 | Mexico |

| 4 | China |

| 5 | Indonesia |

| 6 | Korea |

| 7 | Poland |

| 8 | Vietnam |

| 9 | Canada |

| 10 | Hong Kong |

Total merchandise trade - Leading import partners

Opportunities for UK businesses

Key sectors include transport, infrastructure, health, education, tech and retail. Saudi Arabia is more open to private sector participation and has a great interest in UK experience of PPP, facilities management and SME development.

Find support in this market.

Your local Chamber provides a range of export services and links to overseas markets.

Find your local Chamber here.